Managing one’s finances can be challenging, especially when faced with conflicting – and often wrong – information fed to people, especially on social media.

Buying into common misconceptions surrounding money can be harmful, putting someone on their back foot when it comes to financial health.

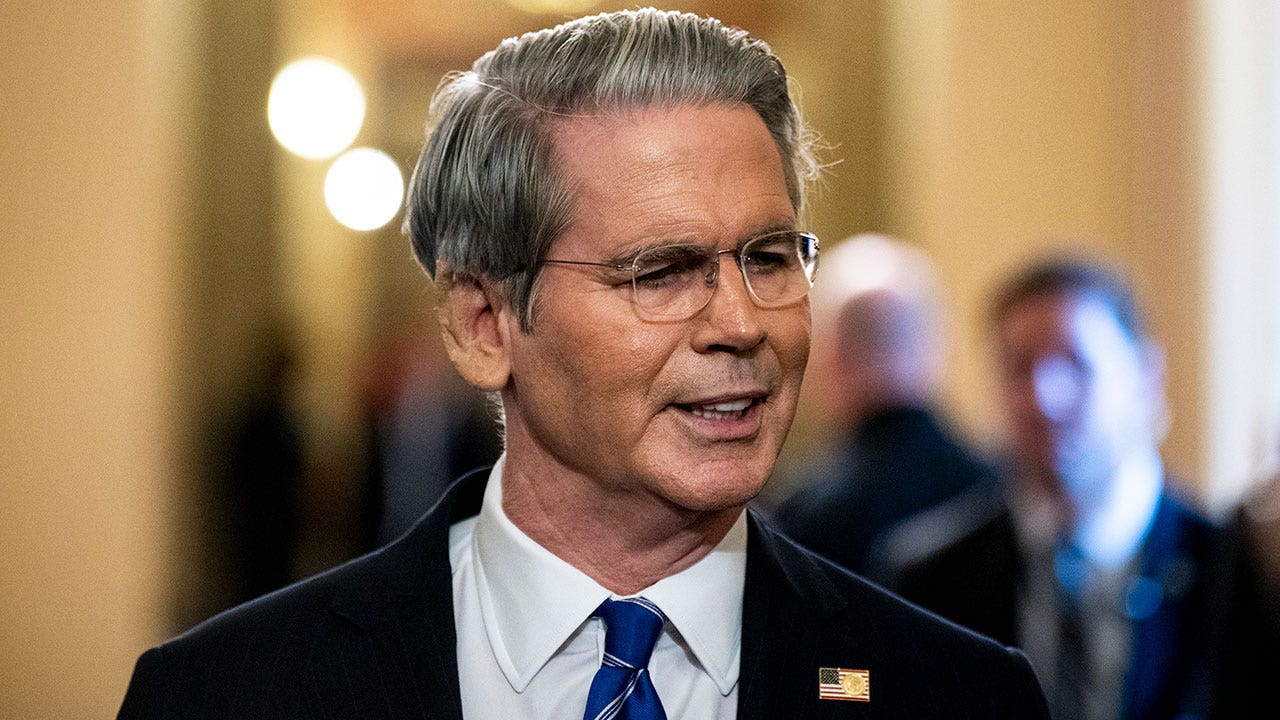

Jonathan Kim, a personal finance expert and the head of finance at online savings platform Raisin, took aim at in an interview with FOX Business, including the idea that “it’s not worth saving unless you can put away a lot,” buy now, pay later being a good budgeting tool, and a high salary being synonymous with financial success.

He also pushed back against the suggestion that people do not need savings accounts and that saving money should not occur before someone is debt-free.

“Some of these thoughts about paying off debt before saving, and not having a full understanding of why you might need savings and why certain debt actually might not be terrible, I think, is a widespread thing,” Kim said.

STUDENT LOAN DELIQUINCIES SURGE, SENDING CREDIT SCORES PLUNGING FOR BORROWERS

The misconception that “it’s just not worth saving right now unless you can put away a lot” is a common one that he said he has seen on social media.

Kim said it’s “pretty easy to fall into this trap where you’re thinking, ‘If I can’t save X percent or X dollar amount, it’s just not worth the effort,’ and that’s a little too outcome-oriented for me.”

He said consistency with saving was important, noting that even “starting with something like $10 a week can help build that financial resilience and can build a habit that sticks with you as you progress.”

When it comes to high salaries and financial success, Kim said, there is “this myth and this propaganda” that a high salary equates to financial success when, in reality, financial health is more about managing money wisely.

Taking home a big paycheck is “obviously a wonderful thing, but I think it’s also very true that lifestyle creep is a very, very real thing, and if you don’t have the financial discipline and conscious saving and spending habits, it’s actually quite easy to just let lifestyle creep happen to you, and you find yourself struggling financially even after you’ve gotten that raise or that promotion or that new job,” Kim said.

Budgeting can be a helpful tool to prevent lifestyle creep, Kim said, while also pushing back on the idea that it has “to be perfect” to work.

“You can have just a general understanding of what’s going in and what’s going out to get you started,” he said. “And once you have that tracked, if you look at it over time, you can see ‘oh, I was only spending X amount, now I’m spending X times two. What happened there?’”

He also said that budgeting helps people “spend intentionally” and does not mean someone has to forgo “everything that brings you joy” to solely focus on necessities.

Kim touched on buy now, pay later services and whether it can be a good budgeting tool.

Buy now, pay later has become increasingly common in recent years as people look to split up and finance smaller purchases.

“If you are buying now and paying later because you don’t have the money now, that means you can’t afford it,” he told FOX Business. “So if you can’t afford it today, you can’t afford it and so by that context, buy now, pay later encourages overspending, and that can lead to you accumulating debt, which then earns interest, and then you find yourself going down that rabbit hole of bad financial habits.”

FINANCIAL EXPERT WARNS AGAINST THE HIDDEN TRAPS OF ‘BUY NOW, PAY LATER’ SERVICES

He said that was “kind of intertwined” with another misconception of people having to pay off all their debt before socking away money as savings.

“If you have high interest debt, like credit card debt, a variable mortgage, student loan debt, anything that could really hurt you or an interest rate can just go up, you certainly want to pay that off,” Kim said. “But at the same time, the other side is that you may be lucky enough to be a person where you got a mortgage five years ago and your mortgage rate is very, very low. In that sense, it wouldn’t make sense to pay that off immediately.”

Building savings while simultaneously making a dent in debt can be very beneficial.

He said it was important to have a financial plan and pay off debt but noted “things can happen in your life,” so setting up an emergency fund by saving can prevent the snowballing of debt and interest should something happen.

He also said having a savings account was better than just using a checking account.

When someone keeps all their money in a checking account, it can be “actually easier to spend and harder to track your goals,” according to Kim.

He noted balances in checking accounts can rise and fall with expenditures and income, making savings difficult to monitor. Many also offer very low or no interest on funds “so your money is actually not working for you,” according to Kim.

A dedicated savings account can establish a “physical boundary, in some senses, where you can see that that money is separate, and you can see it grow over time, which gives you a sense of accomplishment and keeps you going in some sense as it builds,” he said.

They can have high interest rates that will help the savings passively grow over time, he added.

Read the full article here